Falcon Brighter Future

Falcon Brighter Futures fokus er, ud over gode økonomiske afkast, at skabe bæredygtige investeringer, som har en positiv effekt på samfundet og miljøet.

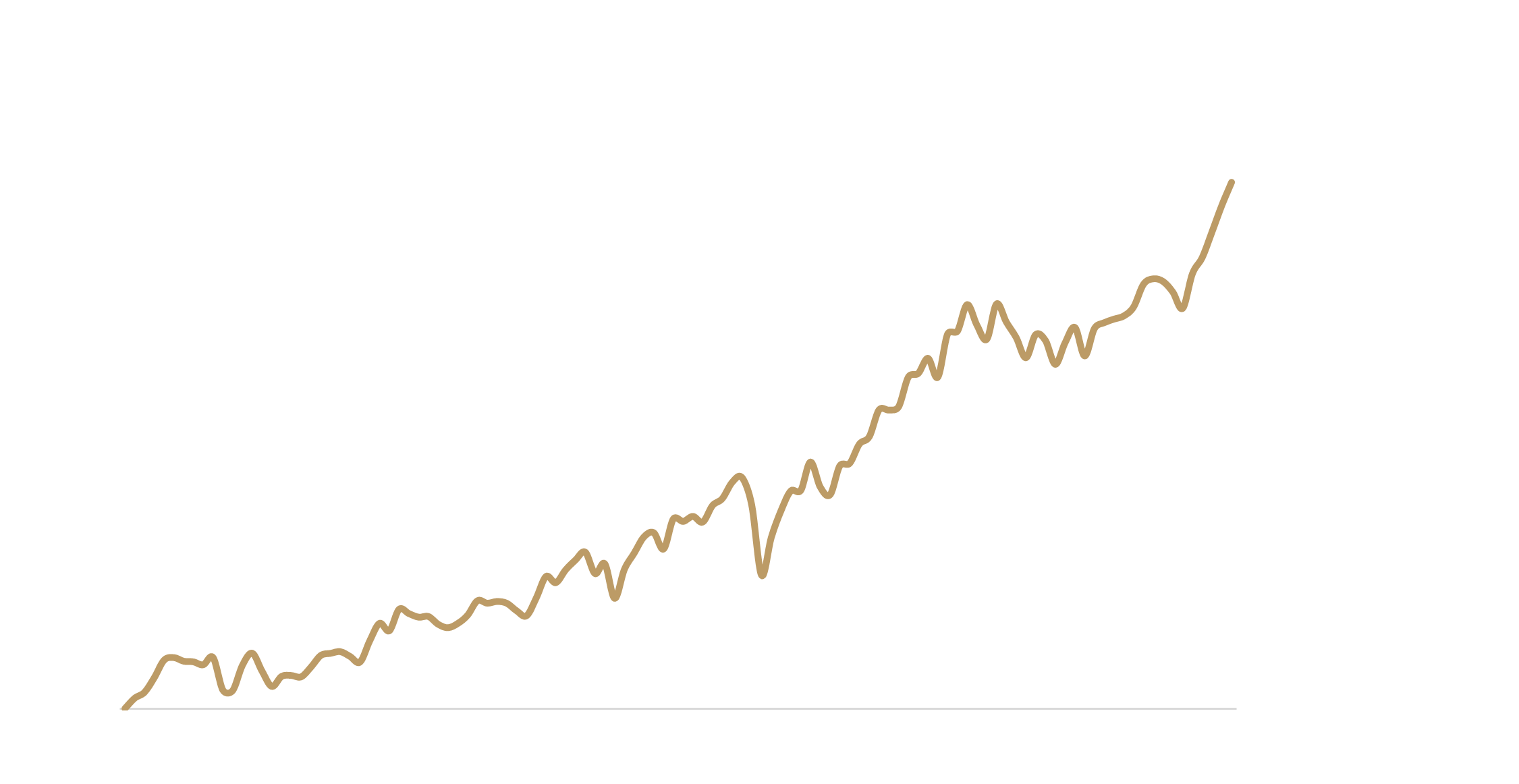

Fondens strategi blev lanceret ultimo maj 2023 efter en fusion af i alt 4 globale fonde.

*Modelafkast indtil 31. maj 2023

ATTRAKTIVE SELSKABER

Falcon Brighter Future investerer i globale selskaber med meget attraktive egenskaber.

Det er selskaber, der er billige i forhold til, hvor meget de er værd, og selskaber, der har stærke og sunde balancer. Det er også selskaber, hvis værdi svinger mindre op og ned end markedet, og selskaber som har klaret sig godt kursmæssigt. Disse egenskaber for et selskab har historisk set givet gode afkast. Det forventer vi også, at de gør i fremtiden.

Køb fonden

Du kan også købe fonden gennem din netbank ved hjælp af ISIN-koden: DK0061152840

FOKUS PÅ BÆREDYGTIGHED & ANSVARLIGHED

Vi investerer i selskaber, som scorer højt i deres respektive branche indenfor bæredygtighed og ansvarlighed. Der er tale om selskaber, der er “best in class”, og som kontinuerligt forsøger at gøre det bedre. Selskaber som er involveret i aktiviteter, såsom produktion og salg af civile skydevåben, tobaksproduktion og salg, eller udvinding af termisk kul og tjæresand, screenes bort.

Falcon Brighter Future er en artikel 8 fond og har en rating på 4 ud af 5 glober i Morningstars bæredygtighedsunivers.

LAVERE RISIKO

Falcon Brighter Future fordeler investeringerne på tværs af op til 250 stærke selskaber, som arbejder indenfor mange forskellige sektorer. Ved også at tage hensyn til, at selskaberne skal have forskellige attraktive egenskaber, finder vi de bedste steder at investere pengene.

At sprede investeringerne på denne måde giver mindre kursudsving og dermed en lavere investeringsrisiko end ved blot at følge markedet.

I Falcon Brighter Future sørger vi for balance i investeringerne. Det gør, at fonden kan danne et solidt fundament i en aktieportefølje.

Der investeres kun i selskaber med akademisk veldokumenterede og påviste egenskaber, som har ledt til et merafkast på langt sigt.

Dokumenter & links

Fakta

FALCON BRIGHTER FUTURE

Risikoprofil: 4 (på en skala fra 1-7)

ISIN: DK0061152840

Finanstilsynet FT-nr.: 11.202.005

ANBEFALET TIDSHORISONT

5 år+

HONORARSTRUKTUR

Læs mere her

INVESTERINGSUNIVERS

Investeringsuniverset består af enkeltaktier, der indgår i MSCI World Index samt investeringer i ETF’er, som dækker samme indeks.

YDERLIGERE INFORMATION

Artikel 8-produkt efter disclosureforordningen.

Der tilstræbes sektorneutralitet

Ingen gearing

Long only / ingen shortselling

INVESTERBARE MIDLER

Alle: Frie midler, VSO, pension.